Long Call Options Strategy: Beginner’s Guide

The long call is a defined risk, low-probability, and bullish options strategy with unlimited profit potential.

.png)

Long call options are bullish market bets that profit when the underlying stock, ETF, or index price rises above the strike price plus the premium paid. These options are a favorite among retail traders because they control 100 shares per contract while requiring far less capital than outright stock ownership.

Highlights

- Long Call: Low probability, defined-risk bullish options trade

- Underlying Asset: The security you are purchasing the call on

- Strike Price: The price at which you can buy the stock

- Expiration Date: The time at which your option contract expires

- Premium: How much a call option costs

Long Call Intro: Ticket Analogy

Let’s say your favorite band will be in town in two months, Theta Decay Disco.

Tickets are currently going for $100, but you only have $5 to your name. However, you expect to have $100 in one month.

Your friend has hoarded 10 tickets and is selling them at $100 a pop, and he expects the prices to go up as the concert nears.

He says, “I’ll sell you the right to buy a ticket at $100 when you get your money in a month (Sept 10th). However, I will charge you $5 for this right.”

Your "friend" writes the details on a paper and hands it to you while you give him $5. And a long call option contract is born.📝

Long Call Trade Details

If you can understand our concert ticket analogy, you already understand how call options work. All you’re missing is the trading jargon. Let’s take care of that now. 👇

- Underlying: Theta Decay Disco ticket

- Ticket current market price: $100

- Expiration date: September 10th

- Strike price (exercise price): 100

- Debit paid: $5

Long Call: Losing Trade Outcome

A month has passed, and Theta Decay Disco tickets have crashed to $80 on StubHub.

Will you exercise your right to buy the ticket for $100 (the strike price)?

No! You will walk away from the deal. You paid for the right to buy the ticket at $100. Why exercise the right to buy at $100 when you can buy a ticket on StubHub for $80?

Total loss: $5 (premium paid)

Long Call: Winning Trade Outcome

Thirty days have passed, and Theta Decay Disco is on fire. Tickets to the concert are currently going for $200!

We bought the right to buy one ticket at $100 for $5. Therefore, we break even at $105.

- Strike price = $100

- Premium paid = $5

- Total breakeven price = $100 + $5 = $105

With a ticket currently valued at $200, we made a profit of $95!

After we acquire the ticket, we can either go to the concert ourselves or sell the ticket on StubHub for $200 and pocket the profit.

- Total profit: $95

But how can we guarantee the seller still has our ticket when we exercise our contract? Maybe he skipped town!

Benefits of Standardized Options

Financial call options (and put options) operate much like the concert ticket in the above example, with one huge difference: options contracts are standardized. This means:

- Options can be traded with any market participant.

- Options follow specific terms regarding expiration dates, strike prices, and lot sizes.

- Government agencies regulate options.

In short, this means you don’t need to trust the other party. Standardized options create liquid markets, allowing you to buy and sell contracts freely while the market is open.

Long Call Trade Example: XYZ

Let’s say you are extremely bullish on the stock XYZ, which is trading at $100 today. You have $300 in your trading account, which will only get you 3 shares of the stock, assuming you don't buy on margin.

But you want more exposure, so you decide to utilize the leverage of options and purchase a call option for a debit of 3 ($300) that expires on December 7th, 90 days from today. Our first stop is the options chain.

XYZ Options Chain

In the stock market, options are organized by expiration date and strike price on options chains.

Millions of options contracts are tied to different underlying assets. In our concert example, the ticket was the underlying. In the stock market, stocks, ETFs, or commodities are the underlying assets. Options get their value from these assets, making them derivatives.

Here’s a portion of an option chain on XYZ displaying the call we will purchase for a December 7th expiration cycle, 90 days away.

.png)

After looking at the above options chain, we see that the 105 strike price call is bid at 3. Remember, one option contract represents 100 shares of stock, so the actual cost here is $300.

XYZ Trade Details

Here are the details of our trade

- Position: Long 1 XYZ Call Option

- Current Stock Price: $100

- Premium Paid: $3 ($300 total for 1 contract, covering 100 shares)

- Expiration: 90 days

- Strike Price: $105

If XYZ rises above $108 (strike price + premium paid) by expiration, we’ll profit because the market price exceeds our cost basis. If XYZ doesn’t rise above $105, we lose the $3 premium.

Let’s now fast forward 90 days to see a potential outcome.

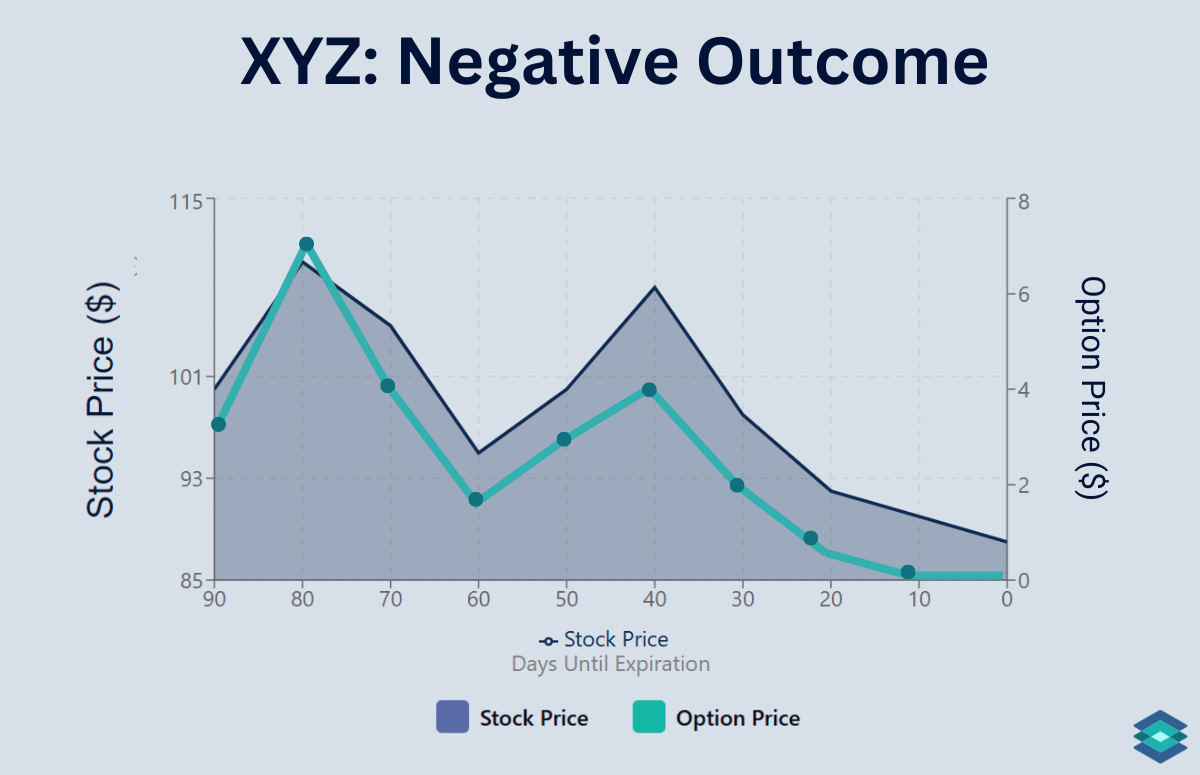

Long Call: Bearish Outcome

Let’s say that 3 months have passed, and the price of XYZ has dropped to $90 per share (ouch!).

- Position: Long 1 XYZ Call Option

- Stock Price: $100 ➡️ $90

- Option Price : $3 ➡️ $0

- Expiration: 90 days

- Strike Price: $105

In a bearish market, call options lose value over time because the stock has less chance of surpassing the strike price. This loss is called theta decay (more on this later). We can see how this time decay works in real-time below.

Even if the stock exceeds our strike price at expiration, we will not profit unless it rises above the strike price plus the premium paid. In this case, the breakeven is $108 (105 strike + 3 premium).

Unfortunately, XYZ fell to $90, making the option worthless. The right to buy at $105 when the stock is at $90 holds no value.

Let’s next explore the two components of an options price.

⚠️ Besides the initial debit paid, it is essential to consider the commissions and fees associated with most options transactions when calculating the net profit or loss. These fees can significantly impact the overall return on investment, and should be factored into any financial analysis or strategy planning. Read The Characteristics and Risks of Standardized Options before trading options.

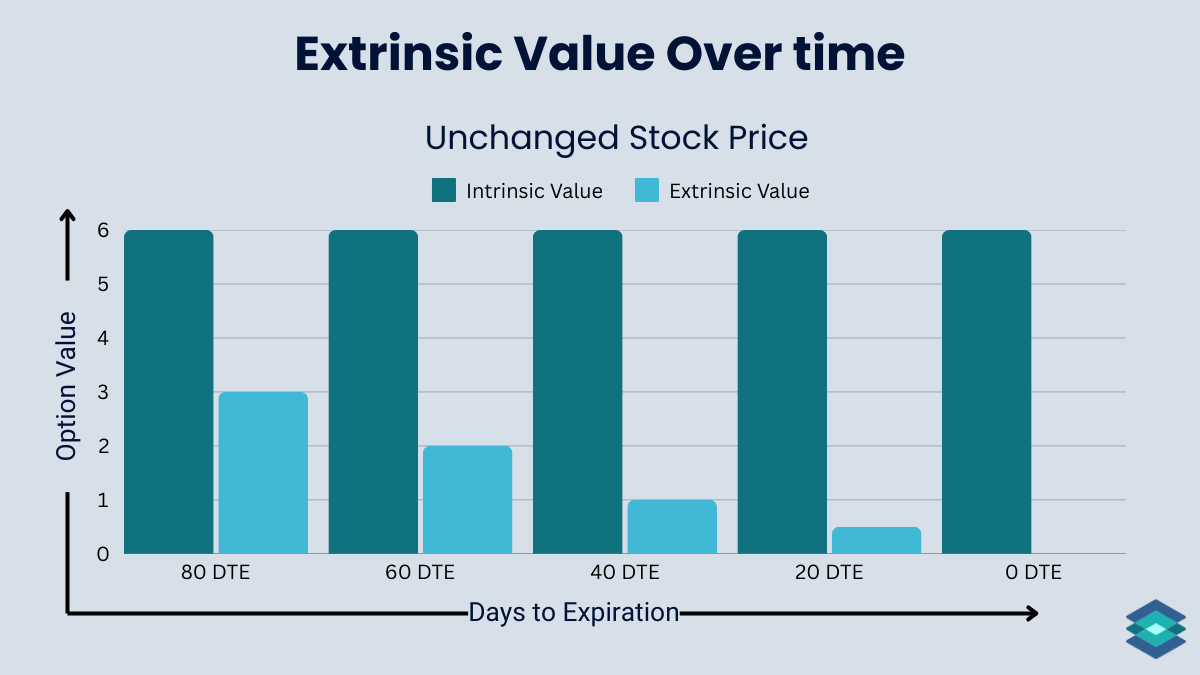

Intrinsic vs Extrinsic Value

Two parts comprise an options price: intrinsic and extrinsic value.

- Intrinsic value: the amount of value an option has based on the stock's current price.

- Extrinsic value: the amount of value an option has beyond intrinsic value, including time and volatility.

For example, let’s say that 20 of the 90 days have passed, during which XYZ rallied in price. Here’s where we’re at. 👇

- Stock price: $100 ➜ $110

- 105 Strike Price Option: $3 ➜ $7.50

.png)

The intrinsic value of our option is $5. Intrinsic value is the amount of value an option has based on the stock's current price. If we exercise our right to buy the stock at $105 (the strike price) while the stock is trading at $110, the option's intrinsic value is $5.

So why is the option priced at $7.50?

Because we still have 70 days until the option expires, which adds an extrinsic (time) premium to the trade. Since extrinsic value is everything beyond the intrinsic value, our extrinsic value for this option is $2.50 ($7.50 - $5).

In addition to time, other factors like implied volatility also contribute to extrinsic value.

🤓 Intrinsic vs Extrinsic Value: Options Pricing Guide

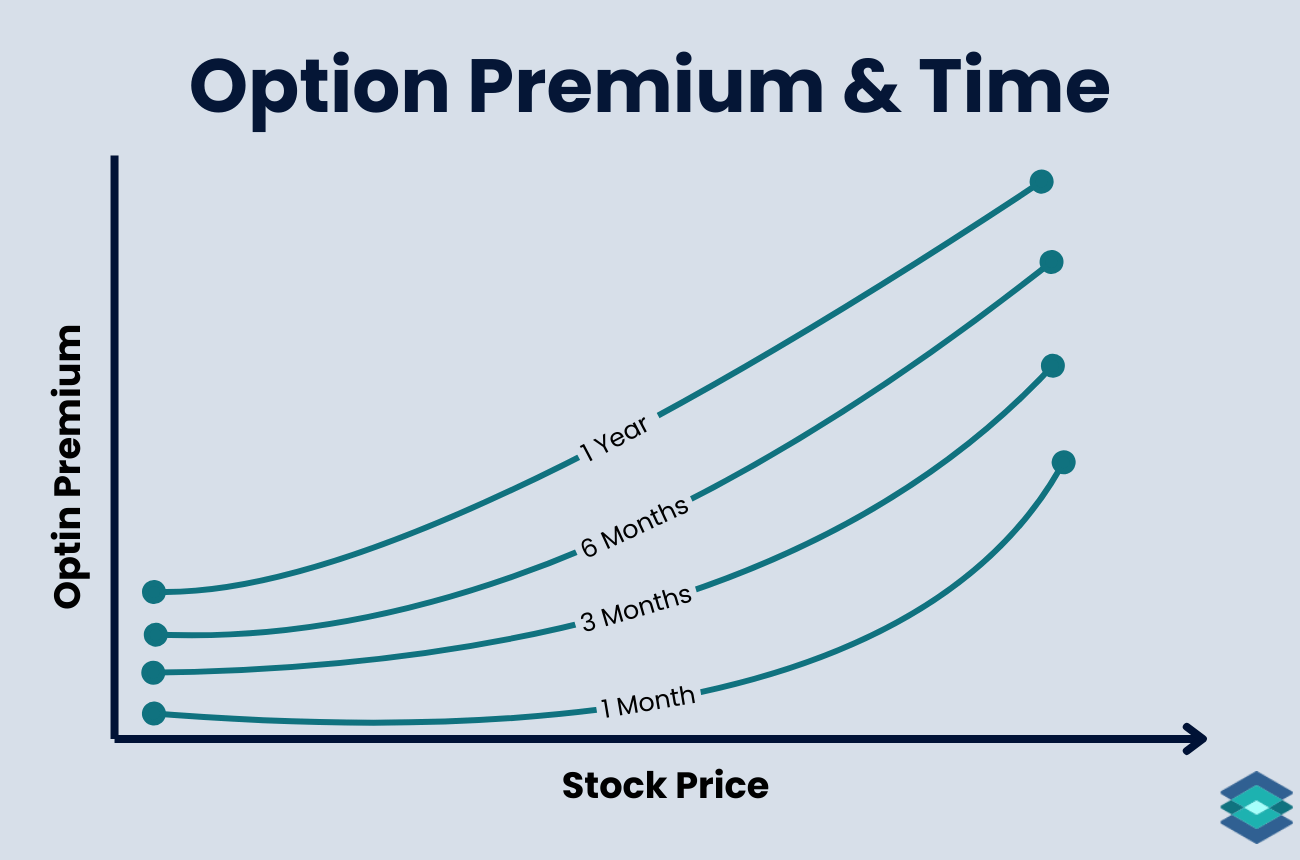

Option Value and Time

As expiration nears, options gradually shed their extrinsic value. In the final moments before expiration, an option's price consists entirely of intrinsic value, with no extrinsic value remaining. At that point, there's no time left for any other factors to impact the price.

Long Call: Option Moneyness

The strike prices of all call options fall into three categories:

- In-the-money: Strike price < stock price

- At-the-money: Strike price = stock price

- Out-of-the-money: Strike price > stock price

.png)

- The further out-of-the-money a call option is, the lower its chance of becoming profitable, so it’s cheaper.

- The further in-the-money a call option is, the more likely it is to be profitable, making it more expensive.

Most retail traders prefer out-of-the-money options because they are cheaper and offer the greatest return potential. You can read more about option moneyness in our dedicated article here.

Another vital prerequisite of options trading is understanding how exercise and assignment work. 👇

Long Call: Exercise and Assignment

- Exercise: The call option holder can ‘exercise’ their option and buy the underlying asset at the strike price.

- Assignment: When the option is exercised, the seller of the call option (also called the option writer) is "assigned" the obligation to fulfill the terms, meaning they must sell 100 shares of stock/contract at the strike price.

At any point in time (for American-style options), owners of long call options can exercise their right to buy 100 shares at the strike price. For every long call, a short must deliver those shares when assigned.

Generally, only in the money calls are exercised, especially when deep in the money. This is because the intrinsic value (market price minus strike price) is high, while the extrinsic value (time and volatility) diminishes.

Exercising a deep in-the-money call maximizes the long's benefit because the option's value is mostly intrinsic. Since extrinsic factors like time and volatility have little effect, holding it longer won't add much value.

Enough theory—let’s put on a trade!

Entering A Long SPY Call: 4 Steps

There are four steps to placing a long call position:

1. Choose a Liquid Underlying

Start by selecting an underlying asset you're bullish on. For this example, we’ll use SPY (SPDR S&P 500 ETF), an ETF that tracks the S&P 500. SPY has high volume and open interest, ensuring that liquidity won’t be an issue.

2. Determine Time Frame

Since all options contracts expire, we must determine our time frame.

We want broad market bullish exposure after the Bureau of Labor Statistics releases the Consumer Price Index (CPI) report in 2 weeks. S&P 500 ETFs like SPY are great for broad market exposure.

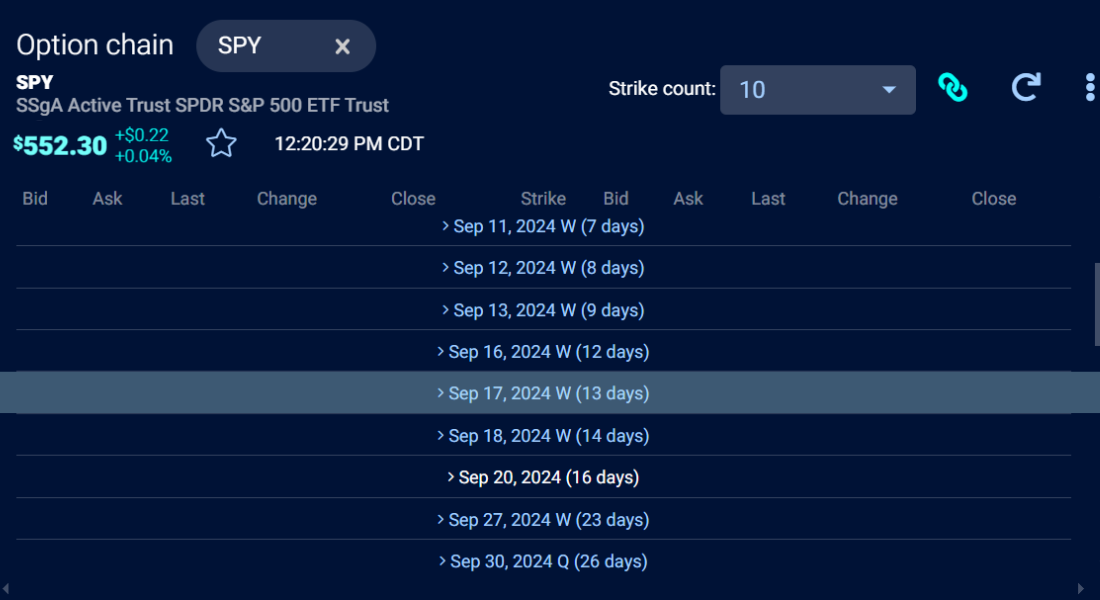

Today is September 1, and the report will be released on the 16th. Let’s also assume we want the market to settle a bit after the CPI print, so we’ll look for an SPY option cycle that expires around September 17th on the TradingBlock platform.👇

3. Choose Your Strike Price

Since we’re bullish on SPY, trading at $552, we’ll buy an out-of-the-money 556 strike price call. Currently, our option is bid at 4.90 and offered at 4.92.

Here’s how this options chain looks on TradingBlock.

💡Buy your first call option risk-free with TradingBlock’s Virtual Trader

4. Enter at Midpoint

Always enter an options trade with a limit order. To get filled quickly, set the price at the midpoint, halfway between the bid and ask prices, and work your way up.

In this trade, the midpoint is 4.91, with a bid of 4.90 and an ask of 4.92. This is a tight market, but consider that options on less liquid assets can have bid-ask spreads over $1 wide!

Using the midpoint as your entry point is a good rule of thumb for all options trades.

Long Call: Our Position

So we just bought a long call on SPY for $4.91. Let’s review our trade details and look at a few possible outcomes.

Our SPY Position:

- Position: Long 1 SPY Call Option

- Premium Paid: $4.91 ($491 total)

- Expiration: 16 days

- Strike Price: $556

- Current Stock Price: $552

Long SPY CALL: Positive Outcome

- Expiration: 16 days → 0 days

- Stock Price: $552 → $580

- Option Price: $4.91 → $24

- Breakeven Price: $560.91

It is now September 17th, the expiration date of our contract. The CPI report came out yesterday, and the market loved it. SPY is now trading at $580/share.

What happened to our call option? Let’s calculate our breakeven first.

SPY: Calculating Breakeven

The breakeven price for a long call is calculated as follows:

Strike Price + Premium = Breakeven

In our case, the breakeven price is:

556 + 4.91 = 560.91

SPY: Calculating Profit

Since the stock rose to $580/share, our profit is the difference between the closing price and the breakeven price:

580 − 560.91 = 19.09

With the stock closing at $580 on expiration, our net profit is 19.09, or $1,909 (each contract represents 100 shares).

Not bad for a trade with an initial investment of only 4.91 ($491)!

Long SPY CALL: Negative Outcome

Now, let’s look at a far more likely outcome.

And here's where our trade ended:

- Expiration: 16 days → 0 days

- Stock Price: $552 → $555

- Option Price: $4.91 → $0

The CPI report came out as expected, and SPY closed at $555/share on September 17th.

Since the stock closed below our strike price of 556, our call expired out of the money, or worthless. Why exercise a right to buy SPY at $556/share when it’s trading at $555/share today?

We lost the entire premium of 4.91 ($491) paid.

If we had just bought and held SPY stock instead of buying a low-probability option, we would have actually made a profit of $3/share!

📖Here's How The Bull Call Spread Works

Time: The Enemy of Long Calls

.png)

At the start of this article, I mentioned that buying out-of-the-money calls tends to result in losses over time. We learned what extrinsic value is. Let’s explore the time component of extrinsic value to determine why.

Let’s say XYZ is trading at $100/share. We are bullish on XYZ and believe it will be trading at $105 in 5 days time. We purchased a 105 strike price call for 0.50 ($50).

Let’s assume in this example that XYZ closes every day unchanged at $100/share over the duration of our contract

So what happens to the price of our call every day?

As we can see, when all other factors remain constant and the stock price stays the same, our option will steadily lose value over time. This gradual loss is known as time decay, or ‘theta’. And the closer to expiration we get, the faster it decays.

Time decay is one of the first lessons options traders learn. Many rookie traders are stunned to see their call option losing value on days when the stock is up. The problem is that the stock isn’t rising quickly enough to outpace the effect of time decay.

Long Calls and the Option Greeks

Theta is just one of the option greeks. In options trading, the Greeks are a series of risk management tools that hint at the future price of an option based on changes in different variables. Here are the 5 most important Greeks to know:

- Delta – Measures how much the option price moves relative to the underlying stock.

- Gamma – Tracks how Delta changes as the stock moves.

- Theta – Measures time decay, showing how much value the option loses daily.

- Vega – Sensitivity to implied volatility, affecting option price.

- Rho – Measures impact of interest rate changes on the option price.

And here is the relationship between long calls and these Greeks:

How To Exit A Long Call

There are four ways to exit a long call position:

- Trade out anytime before expiration.

- Let the option expire in-the-money (just have the money to buy the stock!).

- Let the option expire worthless (out-of-the-money options are zero-bid on expiration).

- Roll the position to another strike or month via a vertical spread.

Long Call Calculator

Use our interactive calculator below to visualize the payoff of any long call option!

Final Word

Buying out-of-the-money calls is akin to buying lottery tickets. They are low-cost, low-probability ways to speculate on bullish price movement. However, because of time decay (theta), long calls, specifically out-of-the-money long calls, perpetually shed value.

What lures many traders is the unlimited profit potential. However, the reality is that most of these options expire worthless. As momma always said, if something appears too good to be true, it probably is.

FAQ

A long call option example: an investor buys a call option on XYZ stock with a $50 strike price expiring in three months for a $5 premium. If XYZ rises to $70, the investor can exercise the option to buy at $50, making a $15 profit per share ($70 market price - $50 strike price - $5 premium).

A long call option gives the buyer the right to purchase a stock at a set price before expiration, typically used when expecting the stock price to rise. A short call option involves selling a call, obligating the seller to sell the stock if exercised, often used to generate income but with unlimited risk if the stock price rises significantly.

Long-term call options, AKA LEAPS, can be a good strategy for bullish investors looking to limit their initial investment compared to buying shares outright. However, time decay can erode the value of out-of-the-money calls, making them risky.

The long call option is an extremely bullish trade. It is also an extremely risky trade.

The greatest disadvantage of long calls is theta, or time decay. With every passing day, if all else remains the same, the value of a call option will diminish.

When buying call options, the most you can lose is the debit paid. When selling call options naked, the maximum loss is infinite.