Options Expiration Guide: Cycles, Risks, and 0DTE

Options expire on a specific date set in the contract, with expiration cycles that include monthly, weekly, and 0DTE (zero days to expiration) options. To mitigate risk, options traders must understand key concepts such as time decay, pin risk, and auto-exercise.

Like most futures contracts, options contracts have a specified expiration date. After this date, the contract becomes invalid and can no longer be exercised. The settlement price of the underlying asset at the close of the last trading day determines if the option has value.

In this article, we’ll explain how option expiration works, walk you through a few examples, and discuss why the latest trend in options trading—0 DTE options—might be a risky strategy.

Highlights

- Expiration Date: Options expire on the date specified in the contract.

- Expiration Cycles: Options cycles include monthly, weekly, and 0 DTE options.

- Settlement Price: The final price of the underlying asset on expiration which determines whether or not an option has value.

- Pin Risk: This risk mostly affects short options, and arises when the underlying asset's price approaches the strike price at expiration.

- Auto-Exercise: Brokers frequently auto-exercise in-the-money options, which may cause margin calls for unprepared traders.

Why Do Options Expire?

Unlike stocks, all options contracts have an expiration date. This is because options are derivatives. Since the price of an option is derived from a separate asset (known as the underlying asset), it must have an expiration date.

After all, what would be the difference between an option and the underlying asset without an expiration?

What Time Do Options Expire?

The regular trading hours of the U.S. stock market are from 9:30 am to 4:00 pm ET. While most options expire at 4:00 pm ET, some have different expiration times. The table below highlights various underlying assets and their respective option expiration times.

Please note that most index options in the U.S., such as SPX and NDX, are European-style, meaning they can only be exercised/assigned at expiration.

In contrast, American-style options can be exercised at any time before expiration. Nearly all stock and ETF options in the U.S. are American-style.

📖 The Ultimate Guide to Options Chains

Option Expiration Cycles

When I started in the trading business some twenty years ago, many stocks and indices had only one monthly expiry cycle, which always landed on the third Friday of the month.

SPY (SPDR S&P 500 ETF Trust), for example, used to have a single expiration cycle for September, October, November, and so on. This day, which we called ‘expiration Friday’ at the desk, was the busiest day of the month. It was forbidden to take ‘expiration Friday’ off!

Options trading has since exploded in popularity, particularly amongst retail traders. To meet this growing demand, more expiration cycles were added. SPY currently has options expiring every single day of the trading week!

What Is the Settlement Price?

In options trading, the settlement price is the final price of the underlying asset, which determines whether an option has value.

Sometimes, very large orders are placed at the market close, shifting the supply and demand dynamic and causing underlying prices to move rapidly in the final seconds of trading. As a result, it may take some time after the official close to determine the actual settlement price of the underlying, which is crucial for assessing the value of your option.

For example, market-on-close (MOC) orders are a type of order with instructions to be filled right before the market closes. Large buy MOC trades can dramatically shift the price of the underlying, especially if there is little liquidity — which is often the case in the final seconds or fractions of a second before the close.

Take a look at the example table, where a few late trades in the final second of trading push the price of XYZ above $100.

This large price swing can spell trouble for options close to being in-the-money. Let’s learn why next.

What Is Pin Risk?

In options trading, pin risk arises when the underlying asset's price approaches the strike price as expiration approaches. This risk significantly impacts short option holders, who must contend with long option holders' decisions on whether or not to exercise their options.

For example, let’s assume you're long a 100-call option on XYZ from the previous example. XYZ closed just over $100, meaning your long call option now has $0.35 of intrinsic value. Assuming you have the funds to purchase the stock and are still bullish on it, would you exercise your option to capture this $0.35 of intrinsic value?

Maybe - and maybe not.

Before exercising a long option that is in-the-money by a small amount, traders typically ask themselves three questions:

- Commissions – Will I still turn a profit after factoring in commissions?

- Price Risk – Since I’ll likely need to hold the stock until the next trading session to sell it, what may happen to the stock price in the interim? Is the potential price fluctuation

worth the $0.35 guaranteed from exercising?

- Exercise Costs – Does my broker charge a fee to exercise an option? Many brokers charge a fee (e.g., $15), which could negate profit from exercising the option.

Options & Auto Exercise

As we mentioned before, pin risk pertains to short options. However, if you don't know the rules of the game, pin risk can equally apply to long options.

In options trading, long option holders have the right, but not the obligation, to buy (calls) or sell (puts) the underlying asset at the strike price. On expiration day, your broker will likely automatically exercise your right to buy or sell the underlying asset if your option is in-the-money.

But what if you don’t want the underlying asset? And if you do, do you have the funds in your account to hold the stock?

Options: Auto Exercise Example

Let’s go back to our previous XYZ example. You are long a 100 call on XYZ that just expired. The call is worth $0.35 ($35), but you don’t have the funds in your account to purchase 100 shares of XYZ, which would cost $10,000 ($100 x 100).

So you decide not to exercise your 100 strike price call option, and that’s it - right?

Wrong.

The vast majority of brokers ‘auto-exercise’ options that are in-the-money. This applies to ALL in-the-money options. If a call option closes in-the-money by as little as $0.01, it will be auto-exercised, and you will be forced to buy the stock - unless you instruct your broker to not exercise your option.

If you don't inform your broker that you wish to forgo exercising an option, the stock will likely show up in your account the next trading day. This can result in a margin call if you don’t have enough funds to cover the purchase. If you fail to deposit funds to cover the position, your broker will likely liquidate the stock to reduce their risk.

How to Pick an Options Expiration Date

The option expiration cycle you choose depends entirely on your strategy and timeline. For example, if you're bullish on XYZ after earnings, you'll want to make sure your expiration date falls after the earnings release.

On the other hand, if you expect XYZ to rise significantly over the next year, a "LEAP" call option, which has an expiration date more than a year away, might be your best bet.

If you're an options seller, aiming for around 45 days-to-expiration (DTE) is often a sweet spot. This window provides enough time to collect a decent option premium as it is right before time decay begins to accelerate rapidly.

Valuing Options at Expiration

All options consist of both intrinsic and extrinsic value. At expiration, however, an option's value is purely intrinsic because the extrinsic value, which includes factors like implied volatility and time, is completely gone.

This means that at expiration, an option's value is determined solely by its moneyness. For example, if ABC is trading at $100 on expiration and you own a 98-strike price call, your option is in-the-money by $2, meaning it has $2 of intrinsic value.

Here’s a refresher on determining moneyness.

What Are 0DTE Options?

0DTE options are contracts that expire on the same day they are traded. These options are popular among traders looking to profit from short-term price movements. Trading 0DTE is a very high-risk strategy. Unless you have a scalping or arbitrage strategy, 0DTE options trading isn’t too different from gambling.

How to Avoid Option Expiration Risks

The best way to eliminate options expiration risk is by closing your position if there’s any uncertainty while the market is still open on expiration day.

If your option is safely out-of-the-money as expiration approaches, you should monitor it, but you probably don’t need to take any action.

For short calls and short puts, if there's any chance the option might close in-the-money, it’s best practice to close any at-the-money or near-the-money options before the market closes, especially if you don’t have the funds or are unwilling to hold the underlying stock.

For long positions that are close to being in-the-money on expiration, it's crucial to monitor the relationship between the strike price and the stock price. Remember, all in-the-money options will likely be auto-exercised by your broker unless you instruct them otherwise.

Option Expiration and Time Decay

As the expiration date of an option approaches, its extrinsic value begins to decay rapidly. This is known as ‘time decay’ in options trading. The closer an option gets to its expiration date, the more pronounced this decay becomes.

- For Option Buyers: Time decay causes options to shed value as expiration approaches, which is bad news for option buyers.

- For Option Sellers: Time decay benefits sellers as short options profit when their value decreases.

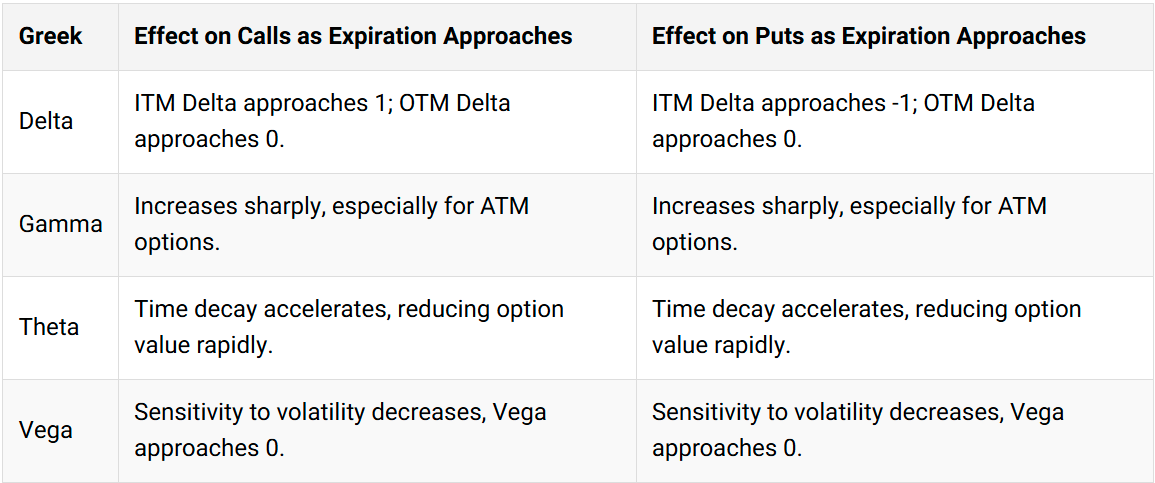

We touched briefly on theta - let’s now take a closer look at the Greeks and their relationships to options expiration.

Explore Options With Virtual Trading

If you’re new to options trading, you may benefit from exploring our Virtual Trading platform, where you can test your trading ideas before placing real money at risk.

FAQ

Most options expire at 4:00 p.m. ET on expiration day. However, a few select ETF options continue trading until 4:15 p.m. ET on the same day.

- In-the-money American-style calls and puts automatically exercise/assign and physical delivery of the underlying asset takes place.

- For in-the-money European-style options (like index options), it’s just a simple cash transfer, no underlying asset is involved.

If you don’t sell a long in-the-money option before expiration, your broker will automatically exercise it. Long out-of-the-money options just expire worthless at expiration.

Only out-of-the-money options expire worthless. In-the-money options are automatically exercised and assigned at expiration.

If a long option is zero bid, you likely won’t be able to sell it, so letting it expire out-of-the-money makes sense. For short options, though, it might be worth buying back your out-of-the-money options if there’s any risk they could end up in-the-money. Better safe than sorry!

For long options, it’s may be better to close them if there’s ay value left. For short options, closing can limit risk if there’s any chance they’ll become in-the-money before expiration.

If you’re long an in-the-money option and don’t exit by expiration, it’ll likely be automatically exercised. If you’re short an in-the-money option, it will be assigned. Out-of-the-money options expire worthless.

When options expire, sellers of out-of-the-money options (both calls and puts) keep the premium they collected, making a profit as the options expire worthless. For buyers of in-the-money options, any remaining value in the option at expiration may result in profit, depending on how much the option cost and how much it’s in the money.

.png)